In application of the term sheet of the Debt service suspension Initiative (DSSI) and its addendum also endorsed by the G20, the Paris Club recognized that the Republic of Mali is eligible to benefit from the extension of the initiative. Therefore, the representatives of the Paris Club Creditor Countries have accepted to provide to the Republic of Mali an extension of the time-bound suspension of debt service due from 1st January to 30th June 2021.

The Government of the Republic of Mali is committed to devote the resources freed by this initiative to increase spending in order to mitigate the health, economic and social impact of the COVID19-crisis. The Government of the Republic of Mali is also committed to seek from all its other bilateral official creditors a debt service treatment that is in line with the agreed term sheet and its addendum. This initiative will also contribute to help the Republic of Mali to improve debt transparency and debt management.

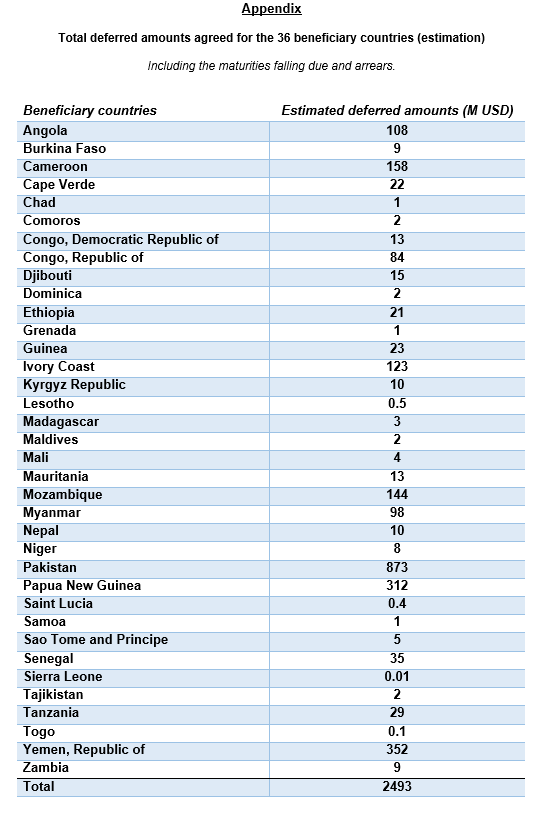

Paris Club creditors will continue to closely coordinate with non-Paris Club G20 creditors and other stakeholders in the ongoing implementation of the DSSI and its extension, so as to provide maximum support to beneficiary countries.

Background notes

1. The Paris Club was formed in 1956. It is an informal group of official creditors whose role is to find coordinated and sustainable solutions to the payment difficulties experienced by borrower countries.

2. The members of the Paris Club which participate in the reorganization of the Republic of Mali’s debt are the governments of France and the Republic of Korea.

Observers to the agreement are representatives of the governments of Australia, Austria, Belgium, Brazil, Canada, Denmark, Finland, Germany, Ireland, Israel, Italy, Japan, the Netherlands, Norway, the Russian Federation, Spain, Sweden, Switzerland, the United Kingdom and the United States of America.

Credit AdobeStock©ZackPixel